Standard 3: Financial Strategies And Allocation Of Resources

Standard 3: The school has financial strategies to provide resources appropriate to, and sufficient for, achieving its mission and action items. [FINANCIAL STRATEGIES AND ALLOCATION OF RESOURCES]

Basis for Judgment

● The school has realistic financial strategies to provide, sustain, and improve quality business education. The financial model must support high-quality degree programs for all teaching and learning delivery modes.

● The school has adequate financial resources to provide infrastructure to fit its activities (e.g., campus-based learning, distance learning, research, and executive education). Classrooms, offices, laboratories, communications and information technology equipment and services, and other basic facilities are adequate for high-quality operations.

● The school has adequate financial resources to provide support services for students, including academic advising and career development, and for faculty, including instructional support and professional development.

● The school has adequate financial resources to provide technology support for students and faculty appropriate to its programs (e.g., online learning and classroom simulations) and intellectual contribution expectations (e.g., databases and data analysis software).

● The school has adequate financial resources to support high-quality faculty intellectual contributions and their impact in accordance with its mission, expected outcomes, and strategies.

● The school identifies realistic sources of financial resources for current and planned activities. The school has analyzed carefully the costs and potential resources for initiatives associated with its mission and action items.

Guidance for Documentation

● Describe the business school's financial resources and strategies for sustaining those resources, demonstrating they are capable of supporting, sustaining, and improving quality consistent with the mission of the school. Provide an analysis of trend in resources over the past five-years, especially in light of different cost structures depending on the teaching and learning models employed.

● Describe the contingency planning process that the school would use, should a reduction in resources occur. The school should be prepared to discuss the specifics of this planning process and expected outcomes with the peer review team.

● Describe the financial support for all major strategic activities (e.g., degree programs, intellectual contributions, and other mission components).

● Describe the school’s financial support for student advising and placement, student and faculty technology, and faculty intellectual contributions and professional development.

● Describe how the resources or financial model have changed in the past five years and any substantial changes anticipated for the next five years.

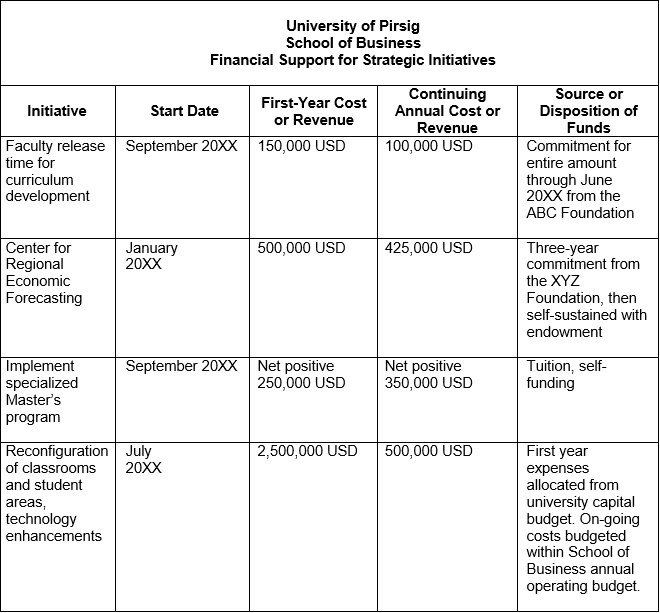

● In alignment with the school’s financial resources, show the sources of funding for the three to four most significant major initiatives using a table similar to the one on the next page.

The table outlines the school’s major initiatives, the implementation timetable, and funding sources. The initiatives identified must be clearly linked to the school’s mission, expected outcomes, and supporting strategies and reflect substantive actions that support mission success, impact, and innovation. This information allows a peer review team to understand what planning the school has done and how this planning fits with the school’s mission, financial resources, and strategies. The school should append to the table narrative explanations of how these action items will enhance mission fulfillment and whether they could necessitate revisions to the mission.

.png)